Most people first notice passive income in a quiet moment.

For me, it was a cold winter morning in New Hampshire. I was sitting in my truck, waiting for the defroster to catch up, when a small notification slid across the screen — a dividend payout that had automatically reinvested. Nothing huge. Just a few dollars.

But in that moment, it clicked:

Passive income isn’t about getting rich overnight. It’s about designing a system that works in the background while you live your life.

That’s the part no one tells you. Passive income is less about picking the “right” investment and more about building engines that keep running even when you’re tired, busy, or thinking about anything else.

Let’s break those engines down so you can build a system that finally starts working for you.

The Three Engines Behind Real Passive Income

Real passive income isn’t magic. It’s structure.

And structure comes from three engines working together.

1. The Financial Engine — Your Money Doing the Heavy Lifting

This engine grows through long-term, low-maintenance assets:

- Index funds and ETFs (your easiest long-term builder)

- Dividend ETFs (steady, reinvesting growth)

- High-yield savings accounts for short-term goals

- Tax-advantaged accounts like IRAs

It works because of a simple truth:

Your money compounds faster than you can manually save.

A small example:

$150 invested each month into an index fund can turn into tens of thousands over time — without raising your income or adding more complexity to your life.

If you’re looking for a strong place to keep cash that still works for you, CIT Bank’s Platinum Savings account is a solid option. Competitive rates, simple setup, and no hoops.

Related reading:

2. The Asset Engine — Create Something Once, Let It Work Repeatedly

This engine includes assets that produce value after the upfront work is done:

- Rental property (or the simpler path: REIT ETFs)

- Digital assets you create once and update lightly

- Intellectual property (guides, templates, tools)

The win here isn’t speed — it’s scale.

You build something one time, and it keeps returning value without constant effort.

Your role becomes maintenance, not daily grind.

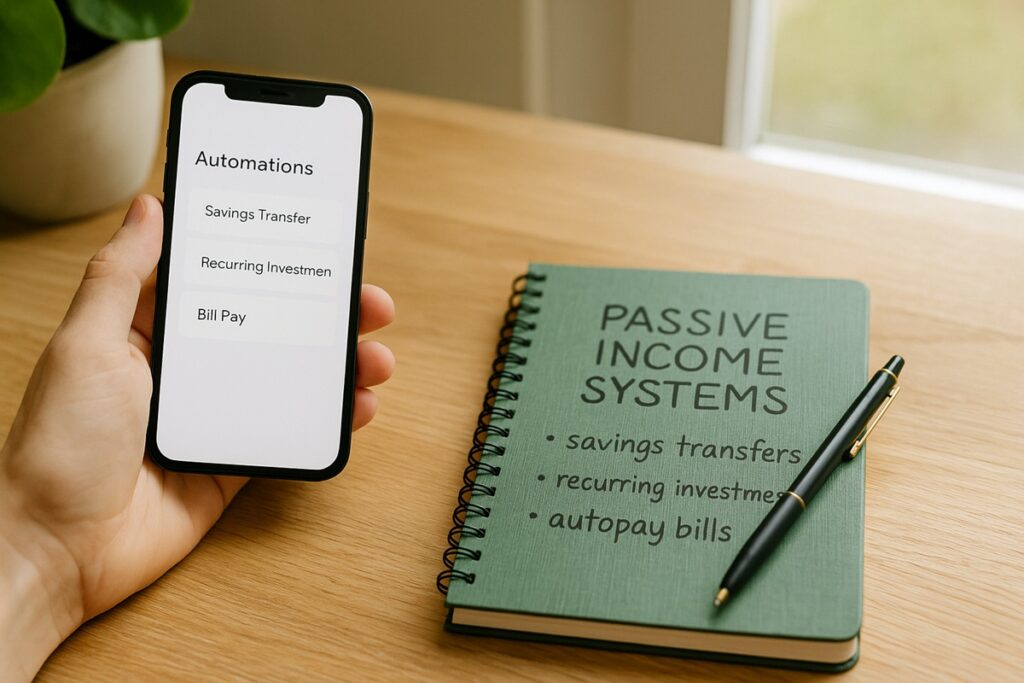

3. The Automation Engine — Quiet Systems That Remove Friction

Automation is what keeps everything moving when life gets busy. A few small setups can handle most of your routine decisions for you:

- Savings transfers that run on the same day every month.

- Recurring investments in your brokerage that happen automatically.

- Autopay for predictable bills so nothing slips through the cracks.

- Monthly or quarterly money check-ins to make sure your systems still match your goals.

- A quick subscription review every 90 days to catch anything you no longer use.

Each one removes a little friction. Together, they create the stability that lets your financial engine keep compounding quietly in the background.

Related reading:

Why Passive Income Fails for Most People

People don’t fail at passive income because they’re bad with money.

They fail because the message they’ve been sold is wrong.

Here’s what actually gets in the way:

1. Starting Too Big

A lot of people wait for the “right moment” — a raise, a bigger tax refund, or a perfectly organized budget. The intention is good, but it quietly turns into postponing progress.

“I’ll invest when I have more money” often becomes “I’ll start someday,” and someday never arrives.

The truth is, momentum comes from starting smaller than you think. Even $25–$100 a month is enough to build a foundation and show you that the system works.

2. Chasing Trends Instead of Systems

It’s tempting to follow whatever is popular — a stock tip on social media, a new crypto coin, or a friend’s “can’t lose” investment. But those choices drain energy, create anxiety, and make it feel like you’re constantly behind.

Real passive income comes from systems that don’t demand your attention every day. Boring is a good sign. Steady is a good sign. Predictable is a good sign.

When your money strategy feels calm and almost routine, that’s when you know you’re on the right path.

3. Not Giving It Enough Time

Compounding doesn’t feel exciting at first. The early growth is so quiet that many people assume nothing is happening, and they stop right before the curve starts to bend upward.

But that slow beginning is part of the process. Passive income takes time to reveal its rewards, and the people who stick with it — even through the quiet months — are the ones who eventually see the momentum kick in.

How to Build a Passive Income Plan That Actually Works

A good passive income plan doesn’t require a dramatic life overhaul. You don’t need a new job, a bigger paycheck, or a color-coded spreadsheet. What you need is a simple structure that grows with you — one step at a time, over a few weeks and months.

Here’s a practical way to build that structure.

Step 1: Build Your Foundation (1–2 Weeks)

Start with the basics — the accounts and automations that give your money a place to grow.

This usually looks like:

- Opening a high-yield savings account for short-term goals

- Setting up a brokerage or IRA for long-term investments

- Choosing your first index fund

- Automating a small, steady contribution

The goal here isn’t perfection. It’s movement. Once the foundation exists, everything else becomes easier.

Related reading:

Step 2: Strengthen Your Money Flow (2–4 Weeks)

This is where you start shifting from “I’m trying to stay on top of things” to “my system handles this for me.”

A strong money flow does the routine work automatically:

- Bills pay themselves on time

- Savings move without you remembering

- Investments happen on a schedule

- You check in once a month to keep everything aligned

These small automations remove the friction that normally derails consistency. They create a rhythm your financial life can rely on.

Related reading:

Step 3: Add One Asset Engine (1–3 Months)

Once your foundation and money flow feel steady, you’re ready to experiment with one asset that can grow over time.

A few options:

- A REIT ETF

- Looking into a small rental property

- Creating a simple digital product

- Developing a skill you can turn into an asset later

There’s no rush and no pressure to “pick the perfect thing.” You’re building capacity — slowly learning what fits your life and what doesn’t. That’s the value of taking this step intentionally.

Step 4: Review Quarterly (15 Minutes)

Every few months, take a short look at your system. You’re checking for alignment, not performance.

Ask yourself:

- Are my automations still running the way I intended?

- Can I increase my contributions by even $10–$20?

- Is anything draining time, money, or energy without giving value back?

These small adjustments keep your system healthy and flexible.

This is how you build stability — the quiet kind that doesn’t burn you out.

A Simple Story of Passive Income Working Quietly

A few years ago, I increased one of my automations by just $25 a month.

It didn’t feel big. Honestly, I barely noticed it leave my account.

Months later, during a quarterly review, I saw the difference:

steady contributions, a little growth, and a small dividend payout I hadn’t expected.

That combination — small decisions, quiet systems, unnoticed progress — is what makes passive income work.

It snowballs while you’re living the rest of your life.

Your First Move — Start Small, Build One Engine

Pick one of these:

- Open a new savings or brokerage account

- Automate your first contribution

- Add your first index fund

- Set up a monthly money review

- Explore one asset engine

Small steps build the system.

Time does the rest.

If you want a simple way to track everything you’re building — savings, investments, habits, progress — the Freedom Tracker comes with Earned Future Weekly.

It’s the same tool I use to review my own systems every week.

Your future grows one quiet engine at a time.