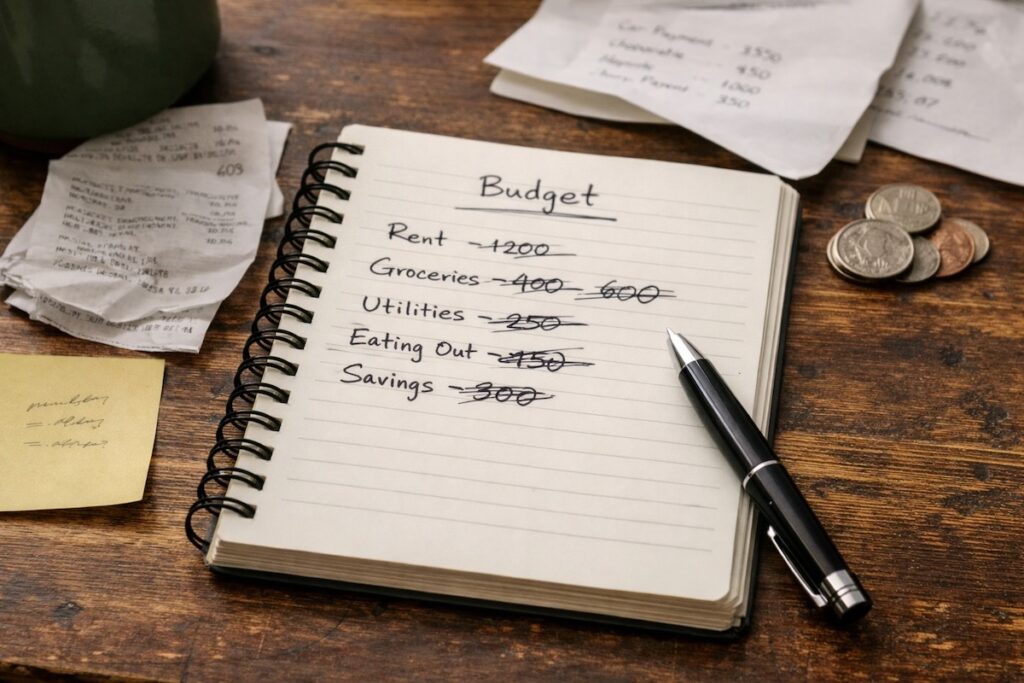

For a while, a budget almost always feels like the answer. You sit down, run the numbers, and suddenly everything makes sense again. Spending feels intentional. You know where your money is going. The tension eases. It’s not that life gets cheaper — it’s that the picture gets clearer. That early clarity is powerful, and it’s the reason a Budget Works at First for so many people.

When Awareness Is Carrying the System

I’ve seen that pattern play out my entire adult life. When I was younger and living paycheck to paycheck, I knew exactly how much money I had at any given time, down to the cent. I didn’t need a spreadsheet or an app to tell me where I stood because the margin was thin enough that awareness did the job. Every purchase carried weight. In that phase of life, attention itself becomes the system.

As income grows, something shifts. The pressure eases, but habits don’t automatically evolve with it. You don’t lose discipline — you just stop needing to monitor every dollar to survive. At that point, budgeting starts to feel optional, and for people like me, it never really worked anyway. I’ve never been able to stick to a formal budget for long. Not because I didn’t care, but because life kept pulling me off script.

Budgets always broke down for me in ways that never showed up cleanly in a category. I was impulsive. I was generous. I’d fill a friend’s gas tank because they were short. Maybe buy lunch when someone didn’t have money. I’d grab extra beer because people were around and it felt right in the moment (I was a little wild back then). None of that fit neatly into a plan, and every time it happened, the budget quietly collapsed. Not in a dramatic way — just enough to make the whole thing feel fragile and unrealistic.

Why a Budget Works at First

When a budget works early, attention usually does the heavy lifting.. You’re checking balances more often. Spending decisions pause in your head before they pass through your card. Numbers stay visible because you’re actively engaged with them. That level of awareness creates control, but it isn’t sustainable forever. Attention is a limited resource, and as life fills up with work, family, stress, and responsibility, the budget starts relying on memory instead of structure. That’s when friction appears.

When Attention Is Doing the Heavy Lifting

This is where most budgeting advice loses people. It assumes a level of consistency that real life rarely provides. The moment a system requires constant correction, frequent check-ins, or perfect behavior, it turns fragile. When something unexpected happens — a busy month, a surprise expense, a lapse in tracking — the whole thing starts to feel like more work than it’s worth.

Why a Budget Works at First, Then Motivation Takes Over

Early success also creates a false signal. It feels like the budget itself is solid, when in reality motivation is carrying it. As long as you’re paying close attention, everything holds together. Once that attention fades, the cracks show. This is usually the point where people turn inward and assume the problem is discipline. They tell themselves they just need to try harder, be stricter, or reset next month. But that misses the real issue. A system that only works when you think about it constantly isn’t finished.

That realization changed how I thought about money. I stopped asking why I couldn’t stick to a budget and started asking why every budget seemed to demand so much vigilance just to survive. Over time, it became clear that most budgets don’t fail because people are careless. They fail because they’re built too precisely for lives that aren’t.

How Precision Makes Budgets Fragile Over Time

Precision looks organized on paper, but it makes systems brittle. The tighter the categories, the more fragile the structure becomes. One overspend forces adjustments elsewhere. One missed update throws off the entire picture. Over time, the mental load builds, and what started as clarity turns into friction. The budget stops feeling supportive and starts feeling like something you manage. That’s usually when people abandon it altogether.

What a Budget Is Actually Meant to Do

This isn’t an argument against budgeting. It’s an argument for what a budget is actually supposed to do. A good budget doesn’t exist to control you or test your discipline. It’s meant to keep you oriented. When used well, a budget acts as a reference point, not a leash. It gives you a sense of direction without requiring constant attention, and it stays useful even when life gets messy.

That’s also why simpler systems tend to hold up better over time. When you remove decisions instead of multiplying them, drift has less room to creep in. Systems that rely more on structure than attention are quieter, and quiet systems are easier to live with. This is the same principle behind automating bills or simplifying account roles — not to give up control, but to make progress durable.

What Keeps Money Working Long Term

Today, I don’t keep a traditional budget, but that doesn’t mean I’m careless with money. I rely on discipline, common sense, and boundaries that match how I actually live. If a new streaming service shows up, something else gets canceled. If something isn’t being used, it doesn’t stay. I can afford more now than I used to, but that doesn’t mean every purchase is justified. Ability doesn’t remove responsibility.

When money starts drifting, the answer usually isn’t a full rebuild. It’s rarely about more rules or tighter control. Most of the time, the better move is subtraction — fewer decisions, wider boundaries, and more margin. If you need a reset, going back to a simple budgeting foundation can help re-establish orientation without adding complexity. A budget that lasts isn’t one you follow perfectly; it’s one that keeps working when you’re not thinking about it.

Reducing Friction Without Adding Complexity

Some people find it easier to stay consistent when money lives in fewer places and is easier to review. A clean high-yield savings account like CIT Bank Platinum Savings gives idle cash a single, clear home while it earns interest quietly in the background. The value isn’t chasing the highest rate. It’s reducing noise. Others prefer a simple written check-in once a month, not to track every transaction, but to reconnect with the system and make sure nothing has drifted too far.

When a Budget Works at First, Perfection Isn’t the Goal

If your budget worked at first and then slowly broke down, nothing is wrong with you. The system simply asked for more attention than real life was willing to give. Money systems that last are built to expect inconsistency, not fight it. They make fewer demands over time, not more. When that structure is in place, effort drops, stress fades, and progress continues — even when your attention is somewhere else.

That’s the difference between a budget that looks good on paper and one that actually holds up over time.